About duty-free items

Thank you for visiting Gold Shop Duty Free.

Please check the conditions and procedures for duty-free items before shopping.

Conditions for Tax Exemption

- You must be a foreign traveler with a passport. Even in the case of a foreigner, those who work at a business establishment in Japan or reside in Japan for more than 6 months do not fall under the category of non-resident travelers.

- Objects must be general items valued at 5,000 JPY or more.

Tax Exemption Points

- All items (except some products) can be purchased tax-free in stores under certain conditions.

- Foreign tourists and other temporary visitors are allowed to shop duty-free.

- To purchase duty-free, you must present your passport or other documents at the store. A purchase record slip will be attached to the passport, etc., and must be submitted to customs upon departure.

Do not remove or lose it

Duty Free Items

We do not sell consumables duty free.

| Objects | e.g., home appliances, bags, shoes, watches, jewelry, clothing, crafts, etc.

|

| Eligible Amounts | Purchases of 5,000 JPY or more without tax. |

| Precautions | If the purchase amount exceeds 1,000,000 JPY, a copy of the passport or other documents will be taken. |

- Goods purchased duty-free must be taken out of the country.

- Tax-exempt sales are not allowed when purchased for business or for sale.

- Duty free procedures must be completed at the store where the purchase was made. It is not possible to apply for duty free together with items purchased at other stores.

- Duty-free processing is done on the day of purchase. Duty-free procedures for items purchased on days other than the day of purchase are not available.

- Duty-free sales to persons other than the passport holder are not permitted.

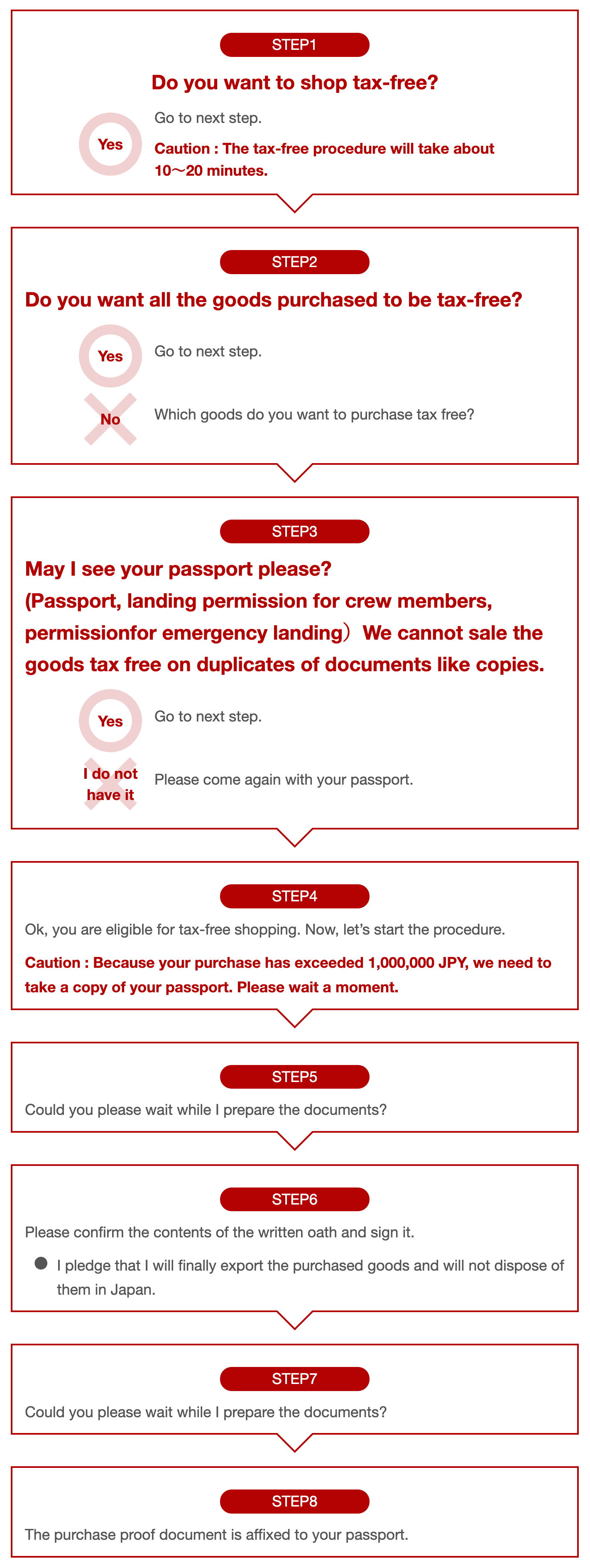

Tax Exemption Procedures

Those who are not eligible for tax exemption procedures

Since there is no stamp confirming the date of entry, duty free procedures cannot be performed.

You work in an office in Japan and cannot apply for tax exemption.

Since it has been more than 6 months since your entry into Japan, You are not eligible for duty free procedures.

The tax exemption procedure cannot be performed because the amount does not meet the tax exemption eligibility amount.

Tax exemption will not be granted for photocopies or other copies.

Duty Free Store Locations

36-22 Udagawa-cho, Shibuya-ku, Tokyo

Rm.1103 NOA Shibuya part 2

Phone number : 03-6455-2883

営業時間:AM10:30~PM8:00

定休日:なし